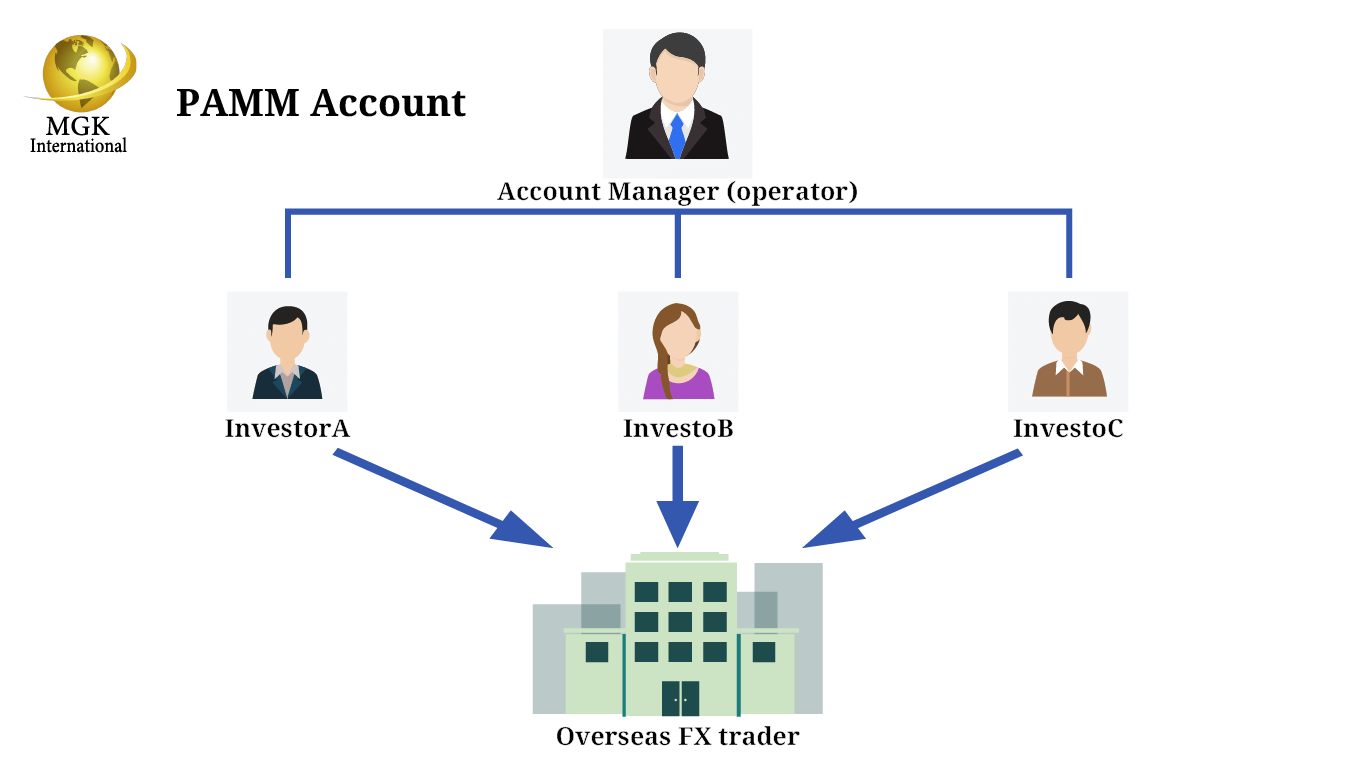

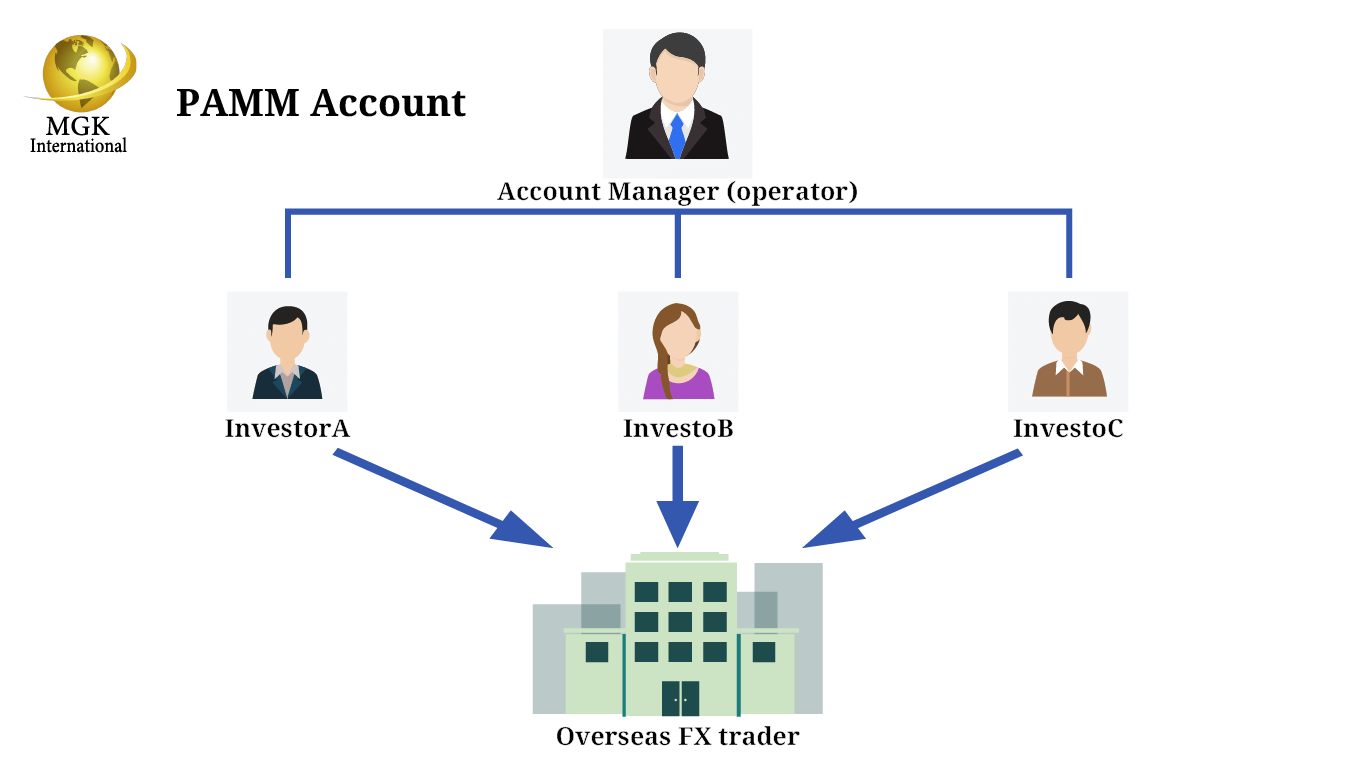

What is a PAMM account?

The PAMM account features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a PAMM account, an investor can also allocate a percentage of his account to one or more managers.

The manager's PAMM account is a large "main account", whose capital is equal to the sum of the sub-accounts.

The manager's trades are automatically replicated in the sub-accounts according to a percentage basis. For example, if the trader makes a 100-lot trade on the EURUSD, the trade is divided among the individual sub-accounts (clients) into smaller parts based on the percentage of equity of each sub-account in relation to the master account. This means that if the size of an individual sub-account is equal to 1% of the main account's equity, the size of the trade on this account will be 1 lot (1% of 100 lots).

What is a MAM account?

The MAM account should not be confused with the MetaQuotes multi-terminal system, which has its limitations. A MAM account allows you to use the percentage allocation method like a PAMM account, but it provides greater flexibility to allocate the trades and adjust the risk of each sub-account based on the clients' risk profiles.

For example, the manager can allocate trades on a fixed basis, which means that he can define the number of lots traded by each individual account. This fixed allocation can also be done using a LAMM (Lot Allocation Management Module) account.

The manager can also change the amount of leverage applied to the sub-accounts if his clients want to take on a greater level of risk.

Features of MAM / PAMM

- Operate third parties accounts through manager account.

- Main holder can withdraw and deposit at will.

- Manager can update EA's or manage personal accounts.

- Cheaper commission and spread can is obtainable.

- That operating costs are often low because it is only the relationship of investors and operators